Algovera Grant Proposal

Name of Project: Compass Labs

Proposal in one sentence: Compass builds automated decision-making tools for decentralised markets on the blockchain.

Description of the project and what problem is it solving:

As a first product, we are building an automated liquidity provisioning platform for the Balancer protocol. From our customer conversations, we have found two main problems:

- Risk: There is a lack of understanding of the true risk of crypto investments, especially with pegs, wrapped tokens and impermanent loss. Proper due diligence takes too long and is a manual process.

- Noise: There are lots of decisions to make when providing liquidity; for example, asset mixes, order types and rebalancing options. This information overload can lead to decision fatigue and analysis paralysis, increasing the barrier to entry for liquidity providers.

We want to solve this using a combination of statistics, agent-based simulation and reinforcement learning to simplify the user experience and increase capital efficiency.

This product will be decomposable in two stages:

Stage 1: Dynamic volatility engine for Balancer pools.

Stage 2: Active liquidity provisioning for Balancer pools.

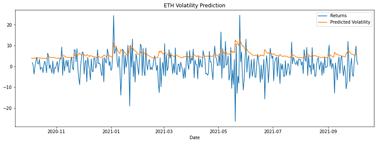

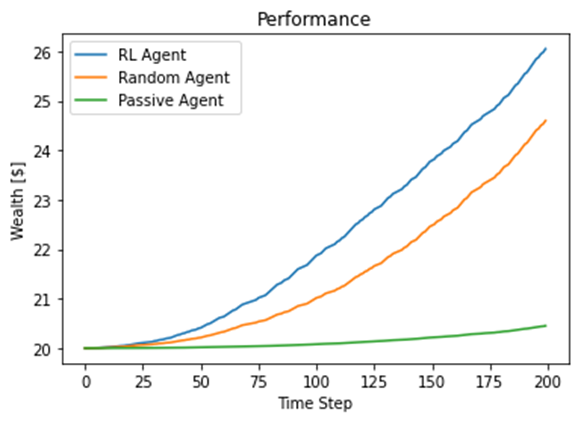

As a proof of concept, we created a reinforcement learning agent to ‘win’ a trading simulation of two other agents with their own predefined strategies interacting with a liquidity pool containing assets obeying the constant product market maker rule (figure 1a). We also built a statistical model to analyse Ethereum returns to predict volatility (figure 1b).

Figure 1: Proof of concept for a) trading simulation using reinforcement learning; b) Ethereum volatility prediction.

Grant Deliverables:

- Deliverable 1: Simulation of a balancer liquidity pool with a liquidity provider, buyer and seller.

- Deliverable 2: Publish our proof of concept algorithm of a trading simulation on the Ocean Marketplace, if the algorithm is kept private

Squad:

- Rohan (Co-founder & CEO) was a Data Scientist at JP Morgan, who also sponsored his Ph.D. in Modern Statistics and Statistical Machine Learning at Imperial College London. Prior to this, he graduated on the Dean’s List with a Masters in Electrical and Electronic Engineering from Imperial College London.

- Elisabeth (Co-founder & CTO) did her Ph.D. in Physics at the University of Oxford. Prior to this she graduated with honors with a Masters in Physics from the University of Groningen. More recently she did an AI and Machine Learning Fellowship at Faculty and has experience at a hedge fund. She is also a partner at Founders and Funders at Oxford’s Business School