Name of Project:

Compass Labs

Proposal in one sentence:

Compass Labs (https://compasslabs.ai/) is bringing the benefits of AI and advanced optimization to decentralised finance. We are using machine learning to build dynamic liquidity provisioning tools, enabling all users of the decentralised economy to provide liquidity with a one-click experience.

Description of the problem and what problem is it solving:

Compass Labs (https://compasslabs.ai/) brings the benefits of artificial intelligence to decentralised systems and optimises for a simple user experience in web3. We develop statistical models and state-of-the-art machine learning techniques such as agent-based simulation and reinforcement learning to inform decision making in decentralised finance.

Our first product is Compass - an end-to-end machine learning system that provides an abstraction layer to make dynamic liquidity provisioning accessible to all retail investors by providing a one-click experience to optimise for risk-adjusted returns.

Currently, liquidity provisioning is complex and investors are not able to quantify risks such as impermanent loss, pool complexity and fee optimisation whilst maximising APY. As an example >50% of liquidity providers on Uniswap is suffering negative returns. As a results, decentralised exchanges face significant liquidity risk because liquidity is concentrated to a few actors with in-house written strategies.

Compass aims to solve this by leveraging the open source infrastructure of blockchain systems through our decision making engine powered by statistics, agent-based simulation and reinforcement learning, to simplify the user experience and reduce barriers to entry for liquidity provisioning. Our dynamic strategies aim to traverse the large possibility of digital asset combinations and non-linear liquidity provisioning paths on decentralised exchanges, and our system selects all liquidity provisioning parameters by itself, while taking into account user-defined risk constraints.

With the product, Compass intends to protect the total value locked in decentralised exchanges from censorship and control by greatly increasing the number of liquidity providers.

At the core of the protocol are the on-chain asset vaults, which can be thought of as an intelligent optimization layer sitting between the liquidity provider and the corresponding liquidity pool on the decentralised exchange. Our liquidity provisioning research stack uses open-source on-chain data, data from centralized exchanges and sentiment data to train our machine learning model. Which predicts real-time price distributions. A constrained optimisation algorithm takes the predictions from the price volatility engine to solve for the portfolio that minimizes risk for a target APY. This enables non-uniform liquidity distribution strategies which are more capital efficient. The optimal position is then given as the vault strategy. Crucially, the results of each stage will be used as feedback to inform and update the model.

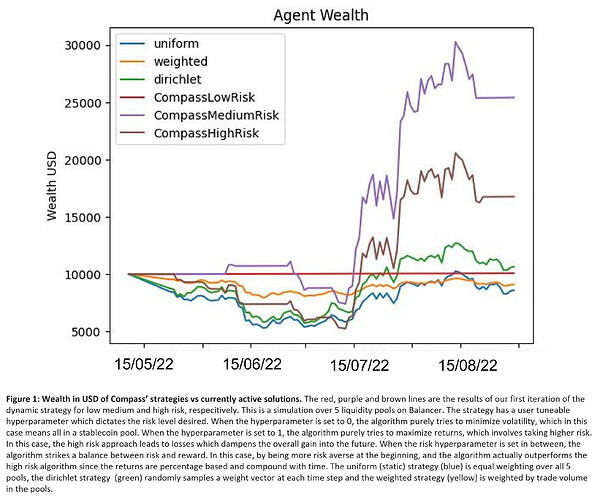

We have done a first iteration of the MVP and the results are shown in Figure 1.

Grant Deliverable 1:

• Extend stochastic volatility model for correlated assets

• Improve dynamic strategies with more feature inputs

• Increase simulation across more pools

Grant deliverable 2:

• On-chain asset vaults

Squad:

- Elisabeth Duijnstee (Co-founder): Elisabeth completed her Ph.D. in Physics at the University of Oxford a year early with multiple first-author papers in leading physics journals. She then joined a hedge fund before doing a Machine Learning fellowship at Faculty AI. She is also a partner at Founders and Funders at Oxford’s Business School.

- Rohan Tangri (Co-founder): Rohan was a data scientist at JP Morgan London, who also sponsored his Ph.D. in Modern Statistics and Statistical Machine Learning at Imperial College London. He also was a lead scientist at Limbic Labs and helped them raise a successful £400K government funding. Rohan also did research with NASA to develop a noise detection algorithm for the InSight mission on Mars.

- Peter Yatsyshin (Research Scientist): Peter is a research associate at The Alan Turing Institute, focusing on scalable methods for statistical inference and machine Learning. He holds a Ph.D. from Imperial College London in computational statistical physics. Peter’s favourite tech stack is jax and numpyro and has successfully applied this to research for the NHS.

Theo Dale (Blockchain engineer): Theo is a software engineer who graduated from the University of Bath with a Masters in Computer Science. Since then he helped multiple start-ups to deliver products ranging from building biodiversity analysis tools to decentralized NFT collateralized lending protocols.

Twitter: @labs_compass

Discord: Discord